owner draw report quickbooks

To do so you are required to select the option of Chart of account at the QuickBooks online homepage and click on the feature option and now open the new tab and move to the drop-down bar of Account Type and choose the Equity option and. In my banking feed beneath neath my.

Running Workers Compensation Reports With Quickbooks Online Youtube

To tie them together we recommend you have actually 4.

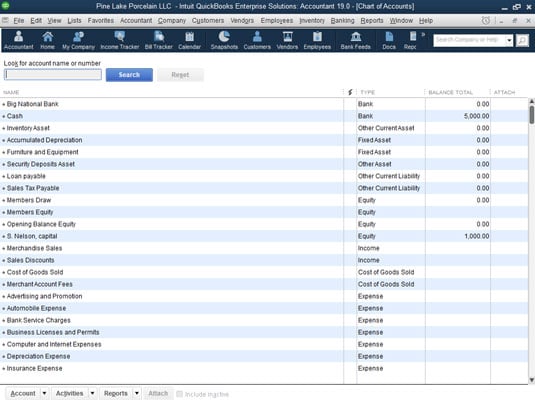

. For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership name Equity do not post to this account it is a summing. Choose Lists Chart of Accounts or press CTRL A on your keyboard. Details To create an owners draw account.

At the bottom left choose Account New. Help with Owner Salary or Draw Posting in QuickBooks Online. With the help of an owners draw account you are enabled to record any kind of withdrawals from the bank account.

Enter and save the information. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. At the upper side of the page you need to.

Select Print later if you want to. Procedure to Set up Owners Draw in QuickBooks Online The Owners draw can be setup via charts of account option. 1 Create each owner or partner as a VendorSupplier.

You have an owner you want to pay in QuickBooks Desktop. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. As a business owner you are required to track each time you take money from your business profits as a.

A clip from Mastering. A members draw similarly called an owners draw or partners draw records the amount taken out of a company by one of its owners. It is another separate equity account used to pay the.

The funds are transferred from the business account to the owners personal bank. Here are some steps. Navigate to Accounting Menu to get to the chart of accounts page.

An owners draw is a separate equity account thats used to pay the owner of a business. Expenses VendorsSuppliers Choose New. Answer 1 of 3.

In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. My trouble is this though I can file the switch in one in all methods and I do now no longer understand which one I ought to pick out.

2 Create an equity. Click Equity Continue. We also show how to record both contributions of capita.

To write a check from an owners. Enter the account name Owners Draw is recommended and description. Open the chart of accounts use run report on that account from the drop down arrow far right of the account name.

QuickBooks records the draw in an. To write a check from an owners equity account. One adds one subtracts.

This article describes how to. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the.

First you can view the accounts balances by viewing their. Since they are equal types then negative for draw and positive for contributions is correct. There are three ways on how you can see the balances for both equity and sub-accounts in QuickBooks Online.

You may find it on the left side of the page. Choose the bank account where your money will be withdrawn. Click Save Close.

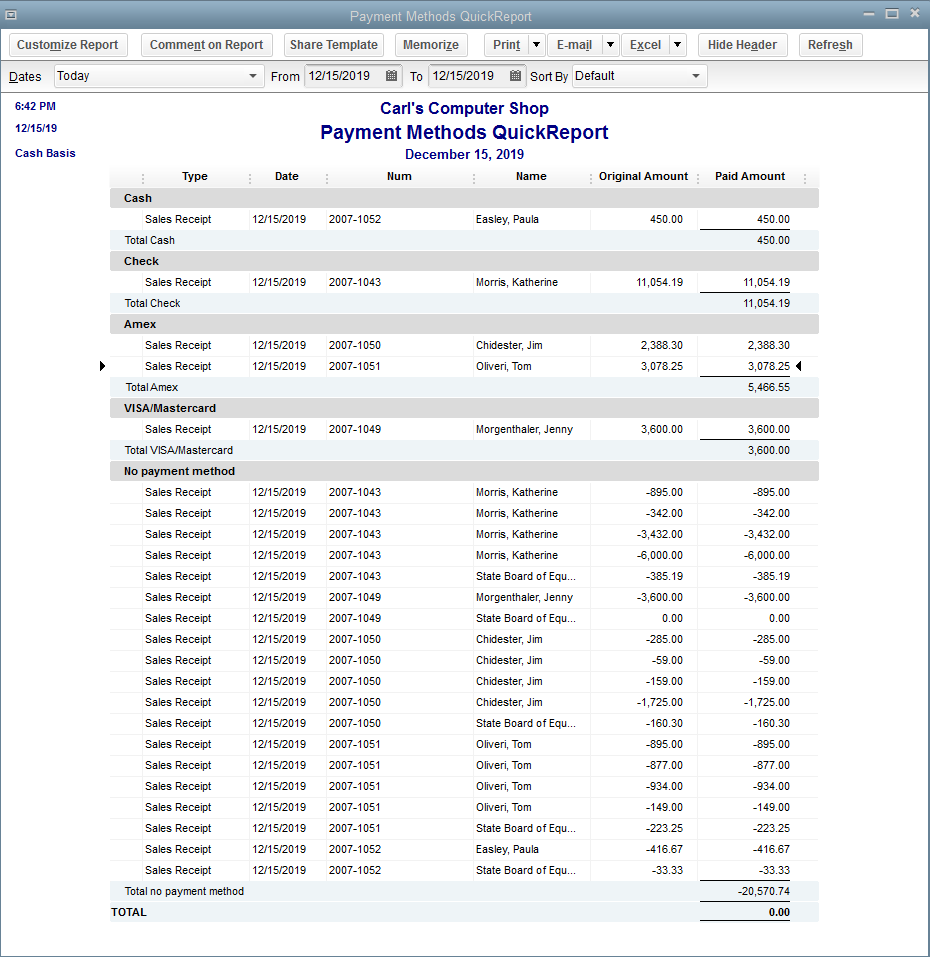

Daily Z Out Report For Quickbooks Desktop Sales Insightfulaccountant Com

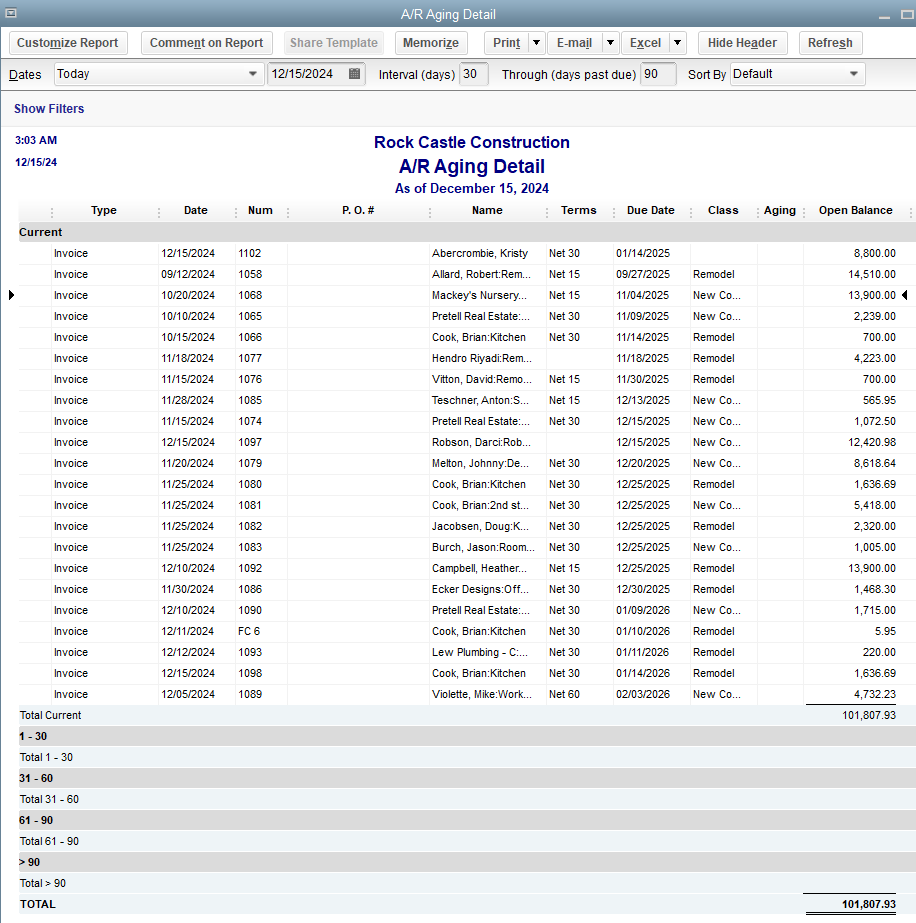

Accounts Receivable Aging Report

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Creating Custom Conditional Formatting Rules In Excel Resume Words Adding Numbers Excel

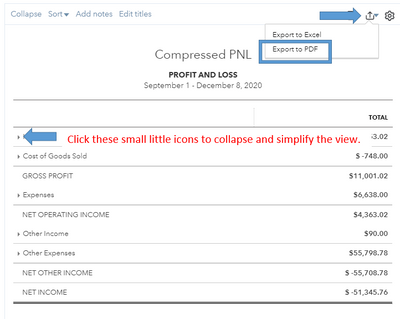

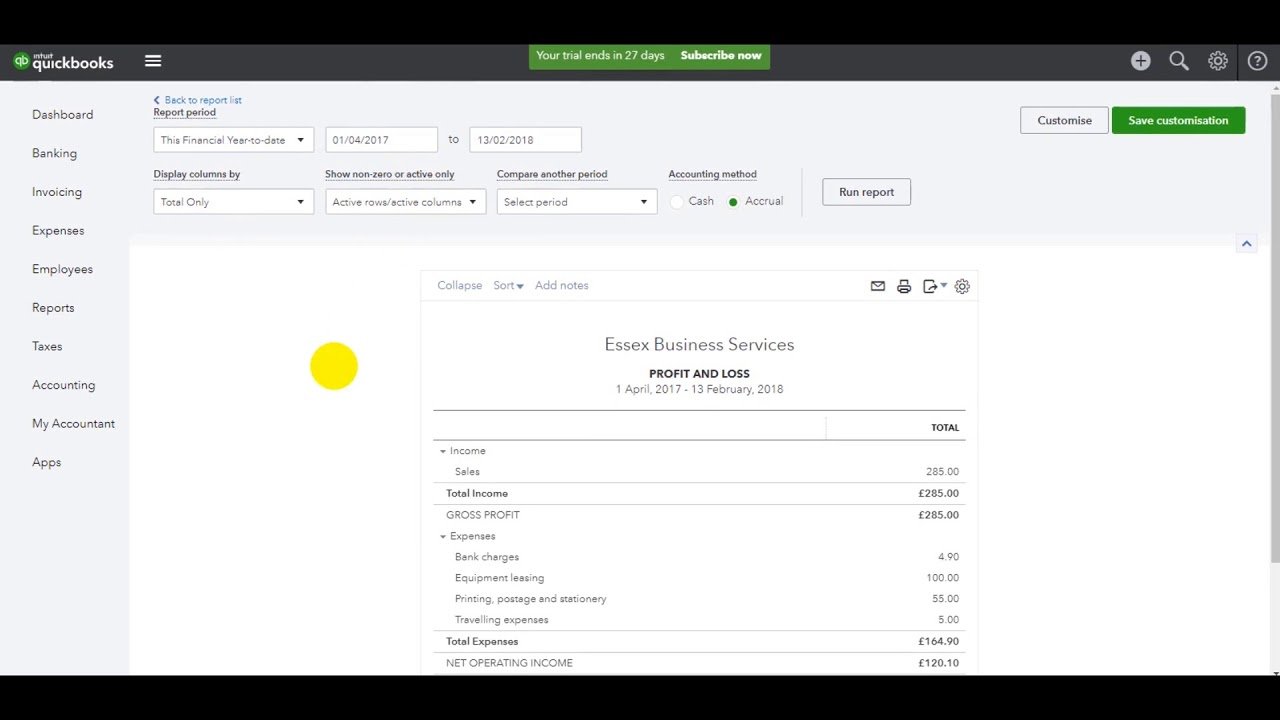

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

Quick Book Reports Templates 3 Professional Templates How To Memorize Things Templates Accounting Basics

Solved Custom Profit And Loss Report

Intuit Quickbooks Desktop Pro Plus 2021 Accounting Software For Small Business 1 Year Subscription Quickbooks Data Backup Accounting Software

How Can I Create A Report For All Invoices Created In A Specific Month Does Not Matter If They Are Unpaid Just Want The Total Of All Sales Made Thanks

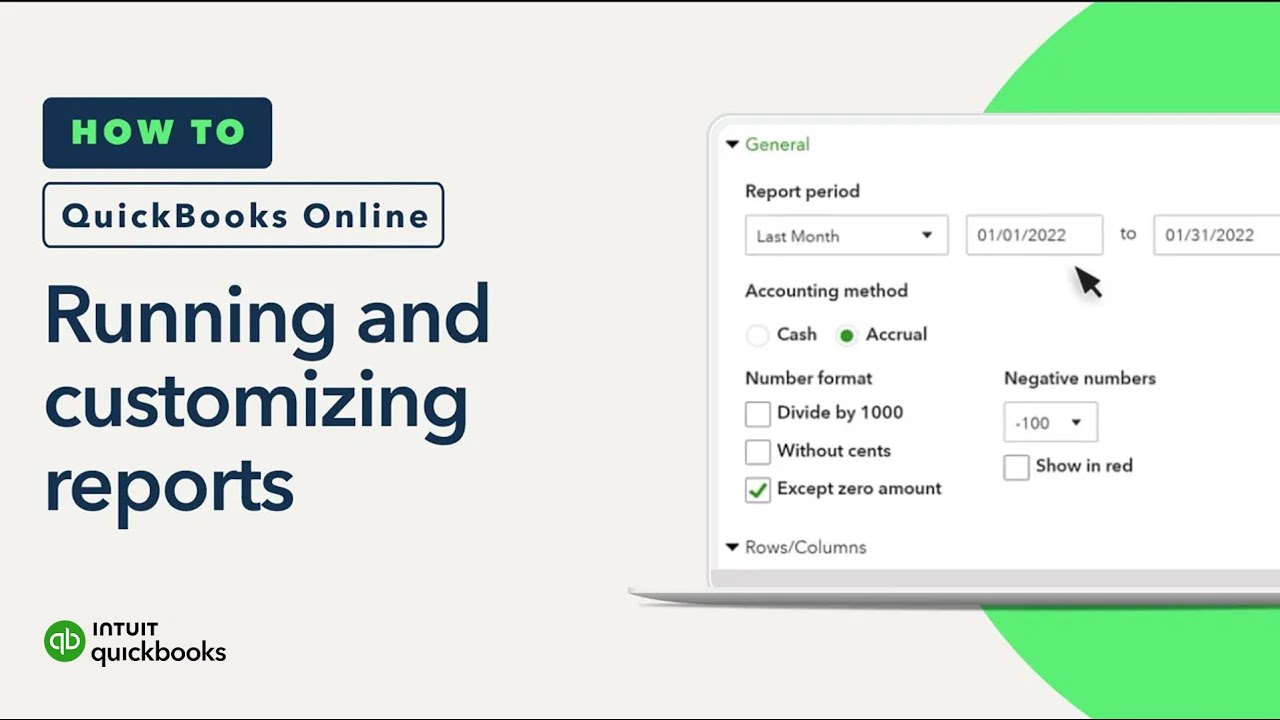

How To Run And Customize Reports In Quickbooks Online Youtube

Quickbooks Ledger Transaction Example Quickbooks Data Entry Bookkeeping

How To Set Up The Quickbooks 2019 Chart Of Accounts List Dummies

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

How Can I Create A Report For All Invoices Created In A Specific Month Does Not Matter If They Are Unpaid Just Want The Total Of All Sales Made Thanks

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Quickbooks Online Tutorial Part 18 Viewing And Creating Reports Youtube