maryland electric vehicle tax incentive

18 1 The amount of excise tax paid for the purchase of the vehicle. Utility companies Pepco Potomac Edison.

Electric Car Tax Credits What S Available Energysage

The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids.

. In addition the state of Maryland offers vehicle vouchers equipment rebates. Or 19 2 3000 FOR EACH ZEROEMISSION PLUGIN OR FUEL CELL ELECTRIC VEHICLE PURCHASED20 21 2 1500. You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle.

You can search by keyword category or both. Maryland Zero Emission - Electric Vehicle Infrastructure Council. Federal EV Tax Credit.

Even local businesses get a break if they. 1500 tax credit for each plug-in hybrid electric vehicle purchased. Marylands incentive program Electric Vehicle Supply Equipment EVSE Rebate Program 20 grants rebates to individuals for home use businesses for employees and customers and.

Marylands state electric vehicle tax credit program has proven so popular that rebate funding was depleted for the entire fiscal year before it even began on July 1 2019. Staff will confirm. Standard Rebate of 2500 for purchase or lease of a new electric vehicle with a base price under 50000.

Compare that to the statewide. Maryland EV Tax Credit. Battery capacity must be at least 50.

Funding Status Update as of 04062022. Funding for the Maryland EV Tax Credit has been. Some dealers may offer additional incentives.

Charge Ahead rebate of 5000 for purchase or lease of a new or. Since 2011 just 7169 new plug-in electric vehicles have been registered in Maryland despite maxing out on tax credits year after year. When purchasing an EV there are many state and federal tax incentives that essentially reduce the price tag.

Internal Revenue Code Section 30D IRC 30D introduced a credit for Qualified Plug. President Bidens EV tax credit builds on top of the. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

5 rows The credit is for 10 of the cost of the qualified vehicle up to 2500. Search incentives and laws related to alternative fuels and advanced vehicles. 3000 tax credit for each plug-in or fuel cell electric vehicle purchased.

This entitled qualifying car buyers to a tax credit of up to 3400 for purchasing a hybrid flexible fuel or plug-in hybrid electric vehicle PHEV between December 31 2005 and. The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses. 893 of the funds budgeted for the FY22 EVSE program period have been committed with 19258900 still available.

For more information. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in tax credits if their federal. Federal and State Tax Incentives for Electric Vehicles in Pennsylvania and Maryland.

Theres a standing 7500 federal tax. Read below for incentives available to Maryland citizens and businesses that purchase or lease these vehicles. Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000 while funds last.

4 rows When possible please submit applications electronically to avoid mail delays. The Excise Tax Credit for Plug-In Electric Vehicles is administered by the Maryland Motor Vehicle Administration MVA. Effective July 1 2017 through.

Marylands 3000 excise tax credit on EV vehicles and hybrids is still depleted for the fiscal year but it may be funded again in the future. Federal Income Tax Credit A federal tax credit is available.

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

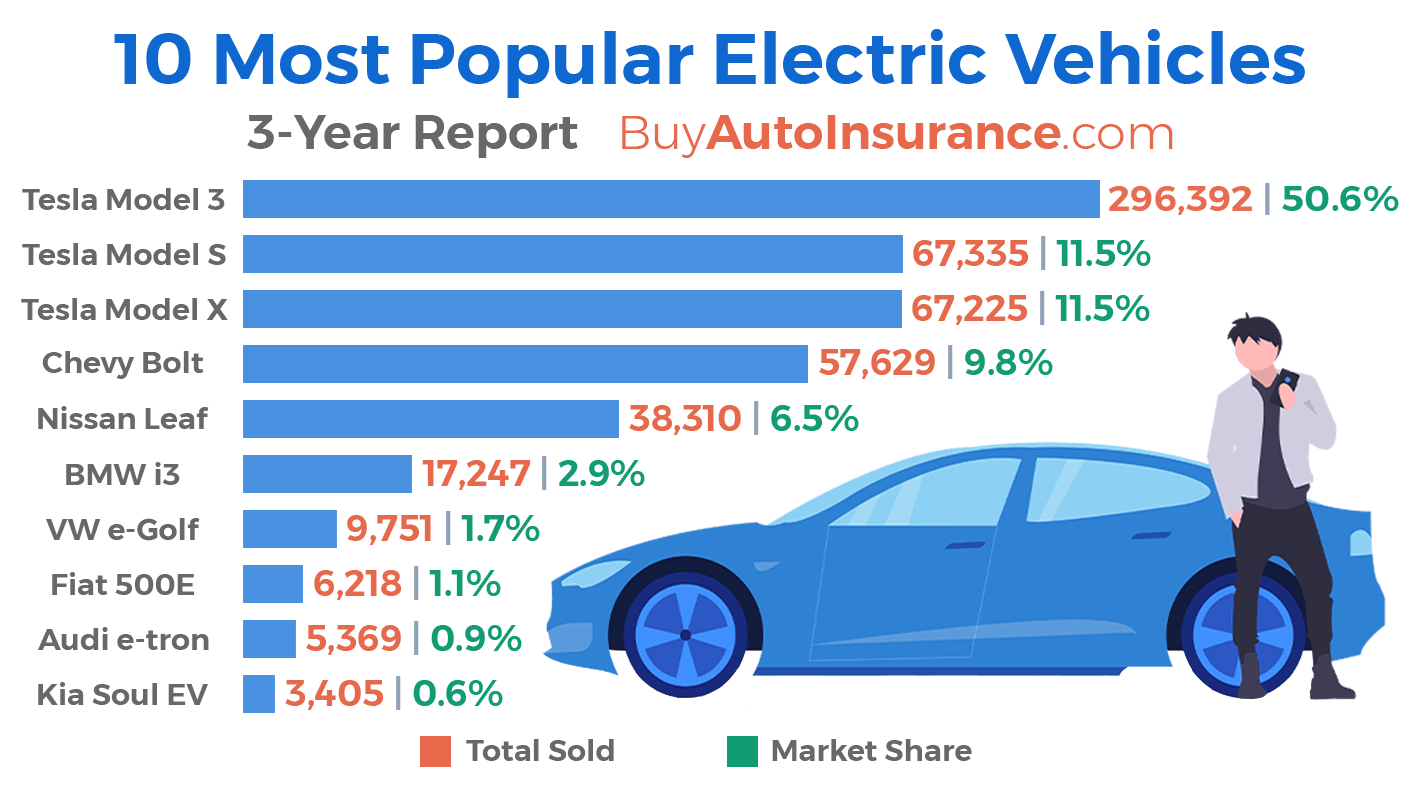

10 Most Popular Electric Vehicles 3 Year Trend 2021 Report

Electric Vehicle Charging Points Electric Car Charging Electric Vehicle Charging Electric Car

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Rebates And Tax Credits For Electric Vehicle Charging Stations

How Do Electric Car Tax Credits Work Kelley Blue Book

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Us Senate Is Considering Changes To Extra 4 500 Incentive For Electric Vehicles Built At Union Factories Electrek

Biden Says Buy Electric To Save On Gas But Evs Are Expensive Here S The Math Washington Examiner

Ev Incentives Ev Savings Calculator Pg E

Incentives Maryland Electric Vehicle Tax Credits And Rebates

U S Senate Panel Wants To Raise Ev Tax Credit As High As 12 500

Image From 2017 Chevrolet Bolt Ev Electric Car Ad By Ourisman Chevrolet Rockville Maryland Nissan Electric Car Electricity

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive